Cá nhân, tổ chức có nhu cầu mua bảo hiểm, giao kết hợp đồng bảo hiểm với Công ty và đóng phí bảo hiểm. Bên mua bảo hiểm phải kê khai và ký tên trên đơn yêu cầu bảo hiểm. Bên mua bảo hiểm có thể đồng thời là Người được bảo hiểm hoặc Người thụ hưởng. Tổ chức: đơn vị được thành lập và đang hoạt động hợp pháp tại Việt Nam. Cá nhân: người từ đủ mười tám (18) tuổi trở lên tại thời điểm nộp hồ sơ yêu cầu bảo hiểm, đang cư trú tại nước Cộng hòa xã hội chủ nghĩa Việt Nam và có năng lực hành vi dân sự đầy đủ theo quy định của Bộ luật dân sự.

Products with high benefits

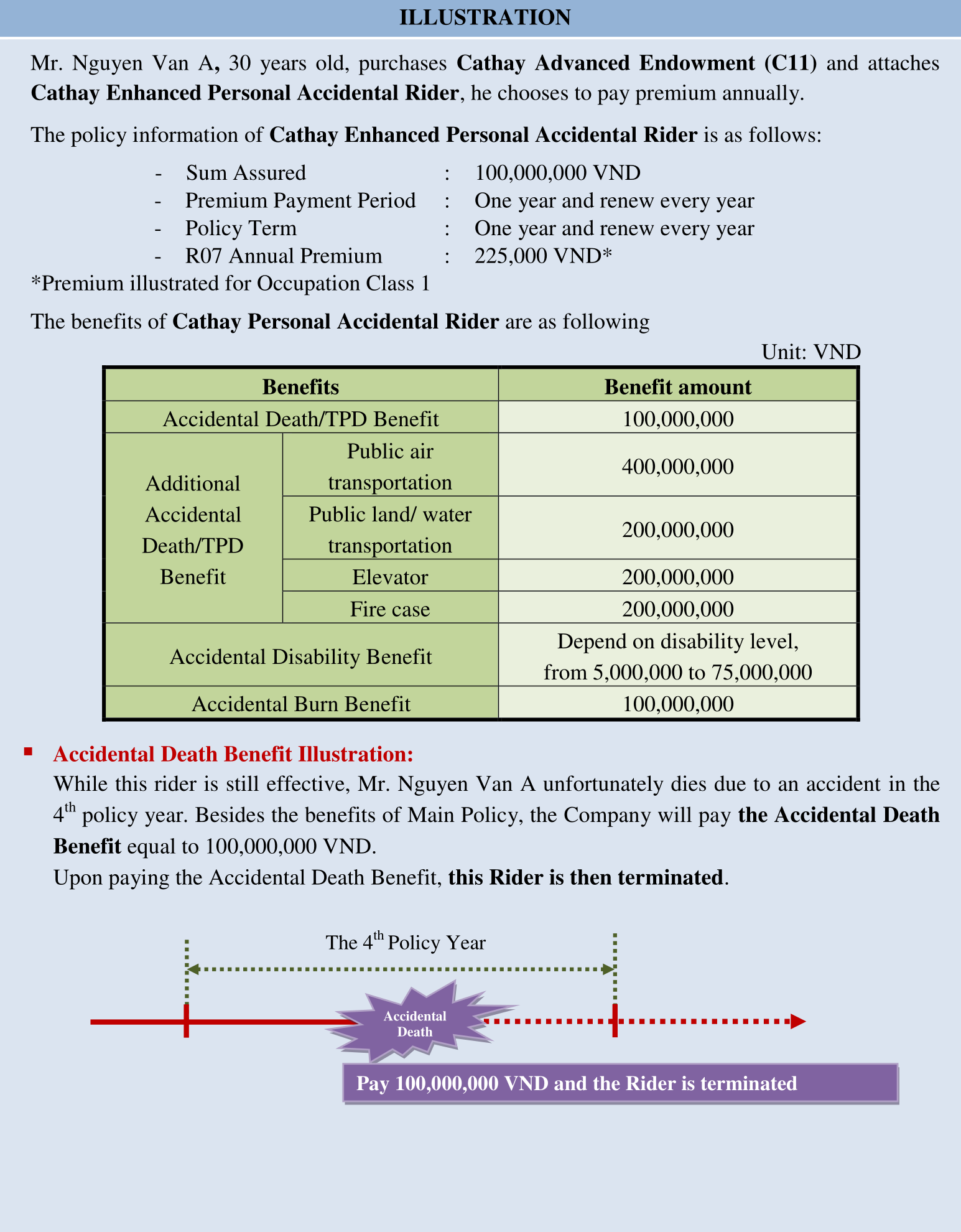

The company will pay 400% of Sum Assured when the customer unfortunately encounters an accident while being a passenger on public transportation by air.